Regional and Sectoral News-Based Indicators for Macroeconomic Forecasting

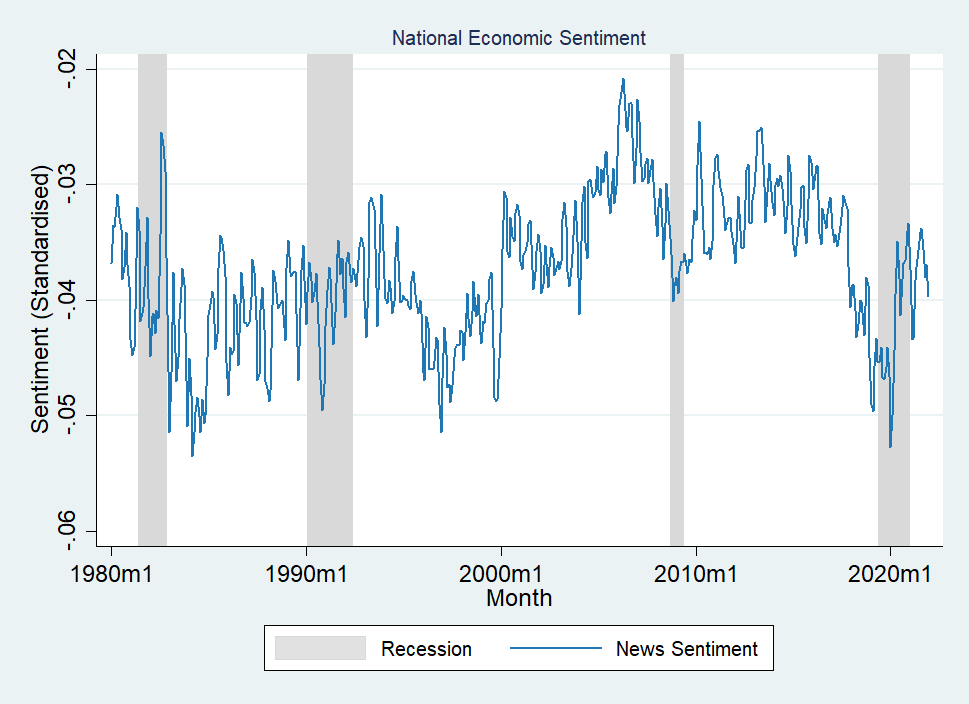

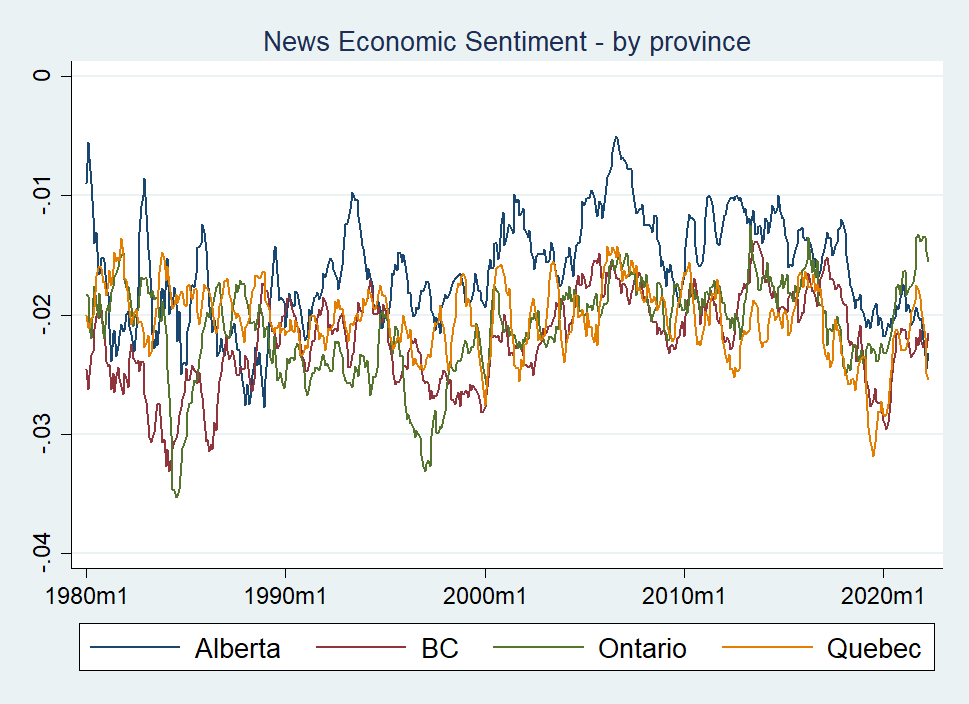

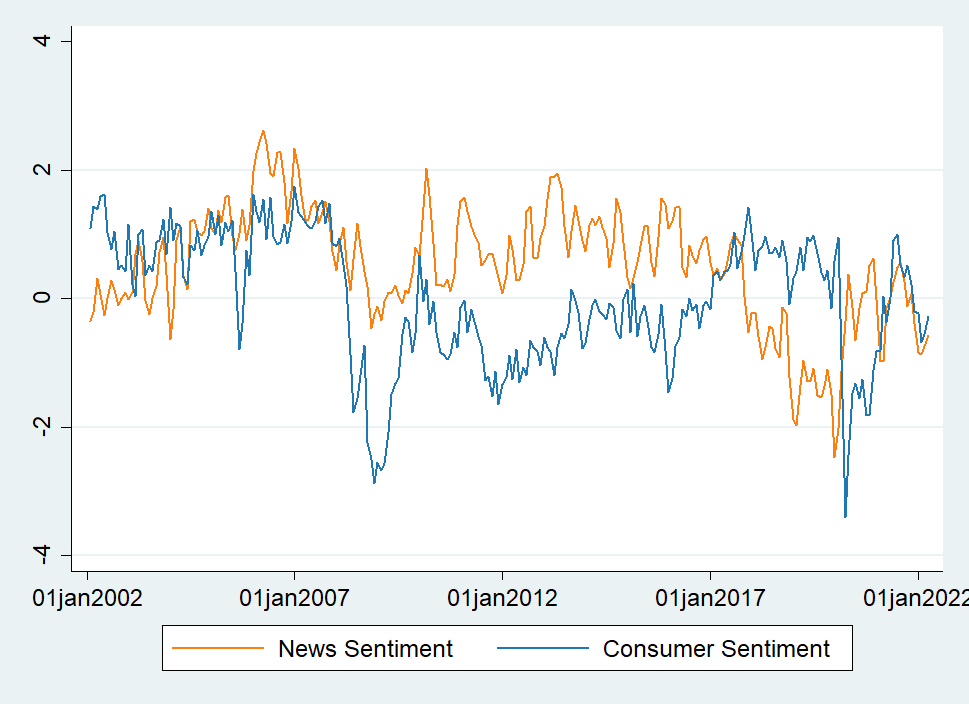

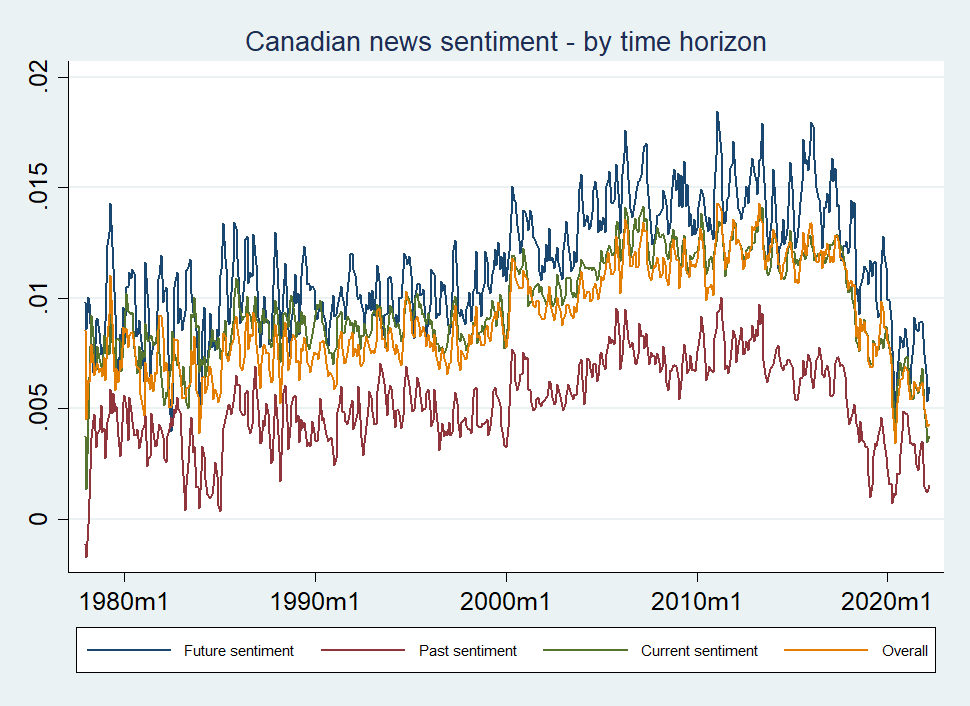

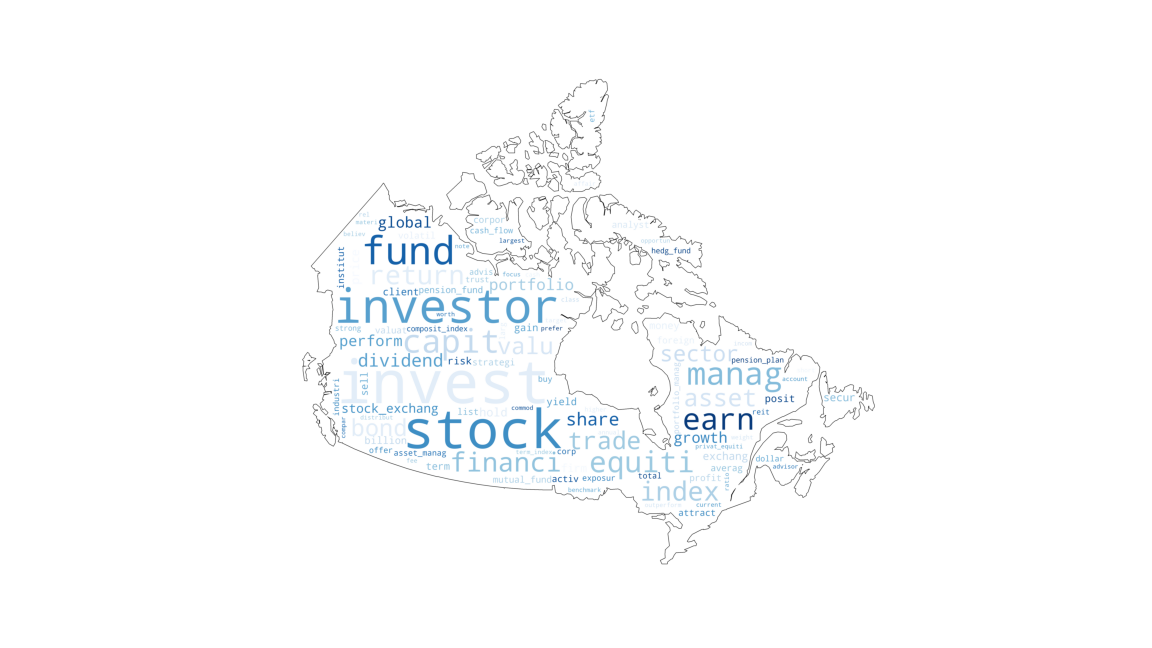

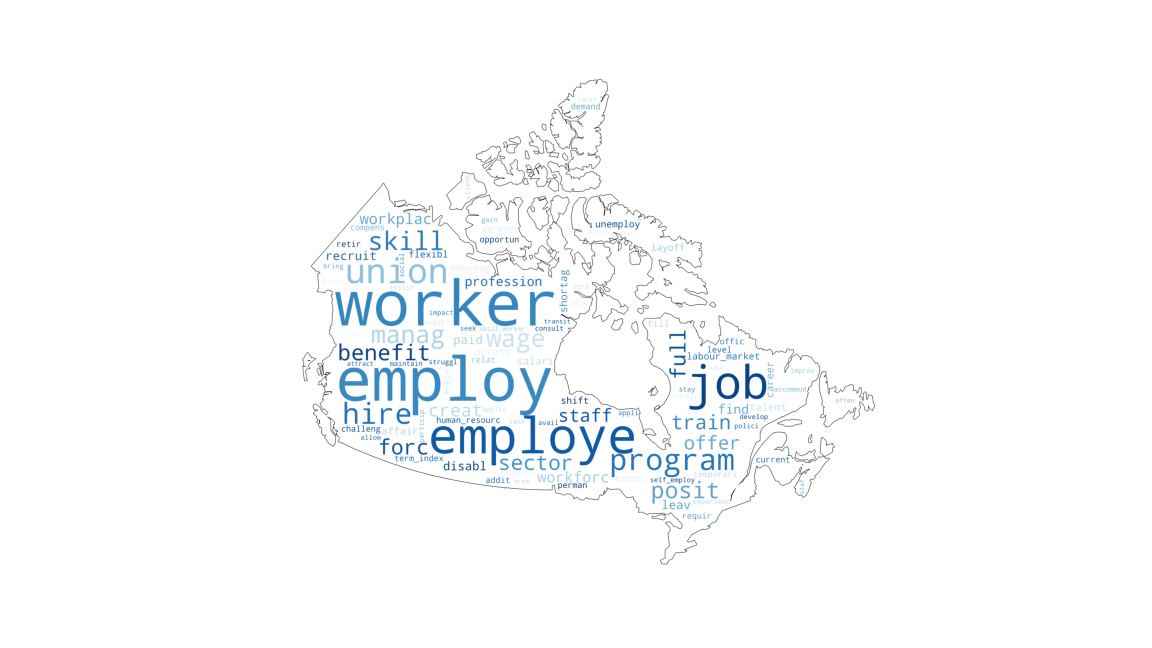

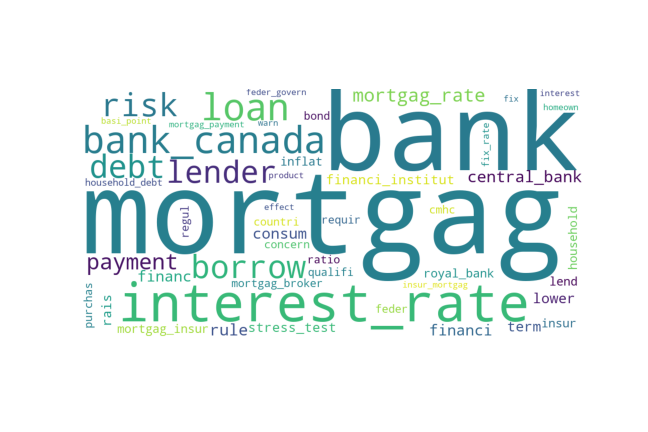

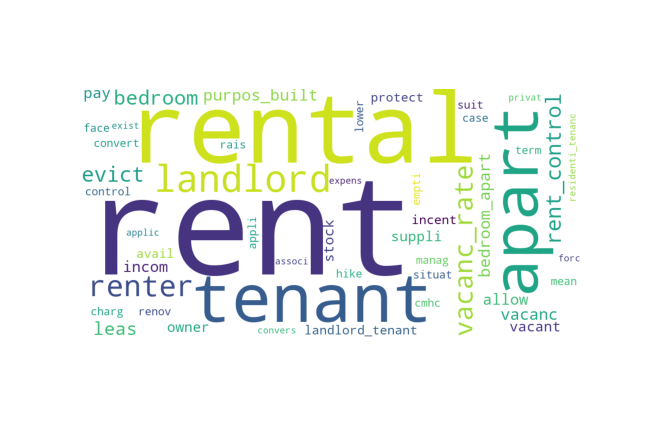

This paper combines dictionary-based methods and topic models to extract timely economic and financial signals at the sectoral (or 6-digit NAICS), provincial, and national levels from Canadian newspaper text and shows that such information can materially improve forecasts of macroeconomic variables, including GDP, inflation, housing prices, and unemployment. I use an advanced machine learning method to isolate information about future, current, and past sentiments. Such indices are extracted from approximately 2 million articles from major Canadian newspapers, including the National Post, Calgary Herald, Edmonton Journal, Montreal Gazette, Ottawa Citizen, Regina Leader-Post, The Globe and Mail, and Vancouver Sun.

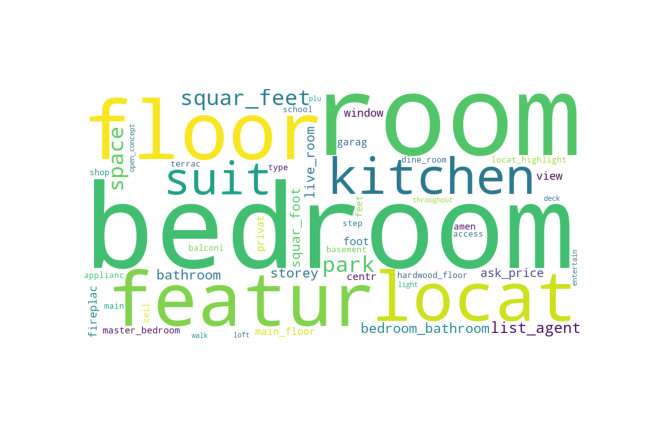

Can Media Narratives Predict House Price Movements?, with Christopher Rauh

This paper investigates how the housing market, a major asset in household wealth, mirrors broader economic trends and we present a predictive model for housing price movements in Canada at both provincial and national levels. Our methodology unfolds in two distinct stages: initially, we process over 2 million newspaper articles through cutting-edge natural language processing techniques to extract media narratives, analyze sentiments, and sort articles according to their focus on past, present, or future events. Subsequently, we implement mixed-frequency machine learning methods to generate a sequence of predictions for quarterly housing prices. The predictions are based on linear models estimated via the LASSO, Ridge, and Elastic net, nonlinear models based on Random Forests, Extreme Gradient Boosting, Artificial Neural Networks, and ensembles of linear and nonlinear models. The results indicate that news data contain valuable information about the housing market's direction. Furthermore, we identify the economic drivers of our machine learning models by applying a novel framework based on SHAP values, uncovering nonlinear relationships between the predictors and house prices.

"Narratives are major vectors of rapid change in culture, in zeitgeist, and in economic behavior."

—Robert Shiller (2019).